Social Security tax deferral. This elective deferral was made on Schedule SE Form 1040 and filed with the 2020 tax return.

Have You Received An Irs Letter About Repaying Deferred Self Employment Tax Erock Tax

How a payroll tax relief deferral may help self-employed people.

. The deadlines for paying your tax bill are usually. Self-Employed taxpayers that made this election are required to pay 50 of. COVID Tax Tip 2021-96 July 6 2021.

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net. Find out if youre able to claim for a Self-Employment Income Support Scheme SEISS grant by checking that you meet all criteria in stages 1 2 and 3. In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from.

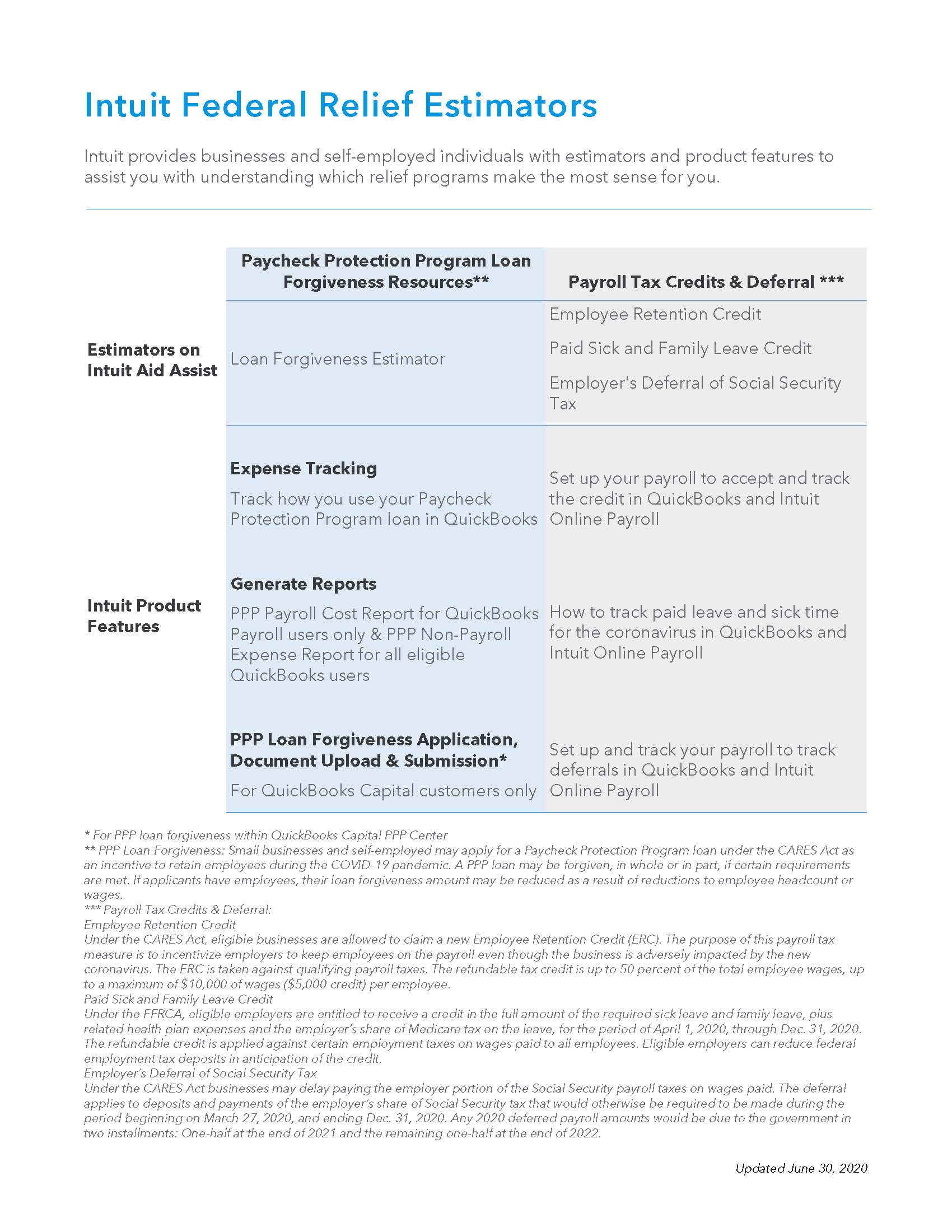

31 January - for any tax you owe for the previous tax year known as a balancing payment and your first payment on account 31 July. We know these are challenging times but you are not in this alone. Many small business owners and self-employed individuals have been affected by Coronavirus COVID-19.

Following some initial confusion HMRC has now updated its advice for businesses and individuals affected by coronavirus to make clear that the six-month income tax self. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net.

The input fields are under Taxes Other Taxes Self-Employment Tax Schedule SE in the. The employers total employment tax liability for all wages paid during the payroll period is 10000. How does the self-employed tax deferral work.

Pay through your tax code. Under the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 the second relief plan unemployment benefits were extended by issuing 300 a week for. You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit against. The employer is entitled to a 15000 employee retention credit.

Employer of any size can defer its payment of employer Social. Lets say your net self-employment earnings for 2020 are 100000. Self-employed individuals are allowed to defer 50 of the Social Security portion of the self-employment tax for the.

Federal Aid Package Helps Individuals Affected by COVID-19 CARES Payroll Tax Deferral. You owe less than 3000 on your tax bill. To get the deferral to flow to Sch 3 you need to make the election to defer.

More details on requirements. Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202 Credits for Sick Leave and Family Leave. You can pay your Self Assessment bill through your PAYE tax code as long as all of the following apply.

As part of the COVID relief provided during 2020 employers and self-employed people could choose to put off paying the employers share of their eligible Social Security tax.

Irsnews On Twitter Self Employed Individuals Can Now To Defer Payment Of Certain Self Employment Taxes As Part Of Covidreliefirs See Irs Answers To Faqs On This Tax Relief Https T Co Kjsse9iopv Https T Co Q9adapox0x Twitter

Deferral Of Se Tax Page 2 Intuit Accountants Community

Payroll Tax Delay For Coronavirus Impacted Businesses

Maximum Deferral Of Self Employment Tax Payments

Tax Deferral Covid 19 Malta Bdo

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Trump Memo On Payroll Tax Deferral Creates A Tax Nightmare Alliance Law Firm International Pllc

What You Need To Know About Self Employment Tax Deferral Taxes For Expats

Cares Act Social Security Tax Deferral And Credit For Employers

Are You Ready For The First Installment Of Repayment Of Fica And Se Tax Deferral

Cares Payroll Tax Deferral Repayments Forvis

Measures For Translators And Interpreters Fit Europe

Covid 19 Income Tax Deferral For Self Employed Black Country Chamber Of Commerce

:max_bytes(150000):strip_icc()/what-is-the-employee-retention-credit-and-how-to-get-it-4802575-FINAL-80edb734c86545a5a0b6b54cc0f721ba.png)

The End Of The Employee Retention Credit How Employers Should Proceed

Solved Where In The Tt Pipeline Can I Find The Question R

Tax Deferral Scheme Lexpractis

Covid 19 Six Month Deferral On Self Assessment Payments Accountancy Daily